Tracking AI search citations: Who’s winning across 11 industries

Citations in AI search assistants reveal how authority is evolving online.

Analyzing results across 11 major sectors shows which domains are most often referenced and what that says about credibility in an AI-driven landscape.

As assistants condense answers and surface fewer links, being cited has become a powerful signal of trust and influence.

Based on Semrush data from more than 800 websites, the findings highlight how AI reshapes visibility across industries.

AI citation trends across industries

The analysis surfaced several clear patterns in how authority is distributed across industries.

Universal authorities

Some domains appeared in the top 50 cited URLs across nearly all 11 sectors, with four domains appearing in every one:

- reddit.com (~66,000 AI mentions across 11 sectors)

- en.wikipedia.org (~25,000, 11 sectors)

- youtube.com (~19,000, 11 sectors)

- forbes.com (~10,000, 11 sectors)

- linkedin.com (~9,000, 10 sectors)

- quora.com (~8,000, 10 sectors)

Other domains are sector-strong but globally influential:

- amazon.com (ecommerce and five other sectors).

- nerdwallet.com (finance-focused).

- pmc.ncbi.nlm.nih.gov (health and academic citations).

Concentration and diversity by sector

Citation concentration varies by sector.

- Most concentrated: Computers and electronics, entertainment, education.

- Most diverse: Telecom, food and beverage, healthcare, finance, travel and tourism.

This means some sectors rely on a handful of go-to sources, while others distribute authority across a broader field.

Relationships between visibility and SEO metrics

AI visibility and AI mentions are strongly correlated (0.87).

Organic keywords correlate more strongly with AI visibility (0.41) than backlinks (0.37).

Keywords and backlinks themselves correlate at 0.79.

By sector, the coupling between AI visibility and backlinks is strongest in computers and electronics, automotive, entertainment, finance, and education.

In these sectors, the scale of authority clearly helps drive AI references.

Sector breakdowns

Finance

Media brands such as Forbes and Business Insider dominate citations, reflecting the importance of timely commentary and market analysis.

However, NerdWallet shows that specialized finance experts can achieve high AI visibility by building deep evergreen guides and comparison content.

This sector also shows one of the strongest correlations between AI visibility and backlink scale, suggesting that authority signals remain highly influential.

Healthcare

Academic and government domains are heavily cited.

The dominance of PubMed Central (PMC), CDC, and national health portals underlines the central role of trusted peer-reviewed or official information.

Wikipedia also appears consistently, often serving as a layperson-friendly entry point.

Diversity is lower here compared with consumer-facing sectors, reflecting the need for evidence-based references.

Travel and tourism

Citations are spread across government advisories (for example, gov.uk travel advice), booking platforms, forums, and user-generated communities.

This diversity reflects the mix of practical (visa, safety), inspirational (guides, blogs), and transactional (booking) content users need.

The sector’s Herfindahl-Hirschman Index (HHI) score is low, suggesting no single authority dominates, and visibility is earned by serving very specific user needs.

Entertainment

User-generated platforms dominate.

Reddit, YouTube, and Quora all appear near the top of cited domains, alongside reference sources such as Wikipedia and IMDb.

This highlights how conversational, community-driven content is central to how AI assistants explain and contextualize entertainment.

In this space, backlink counts are less predictive than breadth of coverage.

Education

Citations concentrate around reference authorities including Wikipedia, university portals, and open-courseware providers.

Specialist learning platforms and forums also feature, but the dominance of well-known academic sources creates a more concentrated citation environment.

Here, AI assistants lean heavily on authoritative, structured content.

Computers and electronics

Technology news and review sites dominate, with CNET, The Verge, and Tom’s Guide appearing prominently.

Wikipedia is again present, but the sector is notable for its concentration, with citations clustering around a few highly recognizable review hubs.

This sector also shows one of the highest correlations between AI visibility and backlink scale, underlining the competitive role of authority signals.

Automotive

A mix of consumer guides (for example, Autotrader, AutoZone) and publisher content.

Insurance and financing providers also receive citations, reflecting user queries that span from buying cars to managing ownership.

Citations are somewhat more evenly distributed, but AI assistants lean on a balance of transactional and informational sources.

Beauty and cosmetics

Influencer-led platforms and community discussion spaces are frequently cited alongside brand websites and review hubs.

The combination of user-generated content and brand authority makes this sector more diverse than average.

Here, social-driven citations compete with established publishing brands.

Food and beverage

Recipe hubs, nutrition authorities, and community cooking sites dominate.

Wikipedia also features, especially for ingredient-level explanations.

The sector has one of the lowest HHI values, meaning a wide diversity of domains are being cited.

Backlink totals are less correlated with visibility here. Instead, topical coverage breadth seems to matter more.

Telecoms

Citations are relatively diverse, ranging from provider help portals to tech media and consumer advocacy sites.

Forums like Reddit often feature in troubleshooting contexts.

The sector’s low HHI suggests no single authority dominates, but users’ practical questions drive AI systems to reference customer-support-style material.

Real estate

Cited domains include large listing platforms (for example, Zillow-type sites), financial services tied to mortgages, and government portals for regulation and housing data.

While concentrated, the sector also pulls from news sources when market conditions are being explained.

Get the newsletter search marketers rely on.

See terms.

Implications for brands and SEOs

The patterns in AI citations carry direct lessons for brands and SEOs, highlighting:

- How authority is built.

- What types of assets AI prefers to reference.

- Why traditional SEO levers now interact differently with visibility.

Reference assets matter

Evergreen guides, standards, and explainers attract citations from both search engines and AI models.

To compete with Wikipedia or government sites, brands need to publish authoritative, fact-checked material that others can comfortably reference.

Breadth of coverage drives visibility

Domains with a wide organic keyword footprint consistently show stronger AI visibility.

This means that covering an entire topic area comprehensively – not just optimizing for a handful of high-volume keywords – positions a brand as a reliable reference source.

Sector rules differ

Each sector rewards different authority signals. In healthcare, peer-reviewed or government-backed resources dominate.

In entertainment, community-driven and UGC platforms rise to the top. In finance, explainers and calculators from expert brands are frequently cited.

Brands need to adapt their content strategy to the trust model of their sector.

Fewer links, higher stakes

AI assistants often cite only a handful of sources per response.

Being included delivers disproportionate visibility.

Conversely, being absent means competitors capture nearly all of the exposure.

This concentration raises the bar for what counts as a reference-worthy asset.

Backlinks still matter, but less directly

While backlink scale correlates with AI visibility, the correlation is weaker than for organic keyword breadth.

This suggests backlinks remain an authority signal, but the breadth and relevance of content may be more critical in an AI-driven environment.

User intent alignment

AI assistants pull from sources that best align with the specific intent behind a query.

Brands that anticipate user needs – whether transactional, informational, or troubleshooting – stand a better chance of being cited.

Creating layered content (guides, FAQs, tools) that matches different intents strengthens visibility.

Becoming a referenced brand

Citations in AI search results reveal the trust networks that underpin the next wave of search.

Wikipedia, Reddit, and YouTube are universal reference points, but sector-specific authorities also matter.

For brands, the lesson is clear: to win visibility in AI-driven search, you need to be the page that others cite.

That means authoritative content, breadth of coverage, and assets designed to be referenced.

Analysis methodology

The analysis drew from AI citation data spanning 11 sectors and more than 800 domains, using responses from Google AI Mode, Perplexity, and ChatGPT search.

Two primary metrics were calculated:

- AI visibility score: The average share of responses in which a domain was cited across Google AI Mode, Perplexity, and ChatGPT search.

- AI mentions: The total number of times a domain was cited across those engines in a given sector.

These metrics were then enriched with:

- Organic keywords (Semrush): The number of keywords for which a domain ranks in organic search.

- Backlinks (Semrush): The total backlinks pointing to a domain.

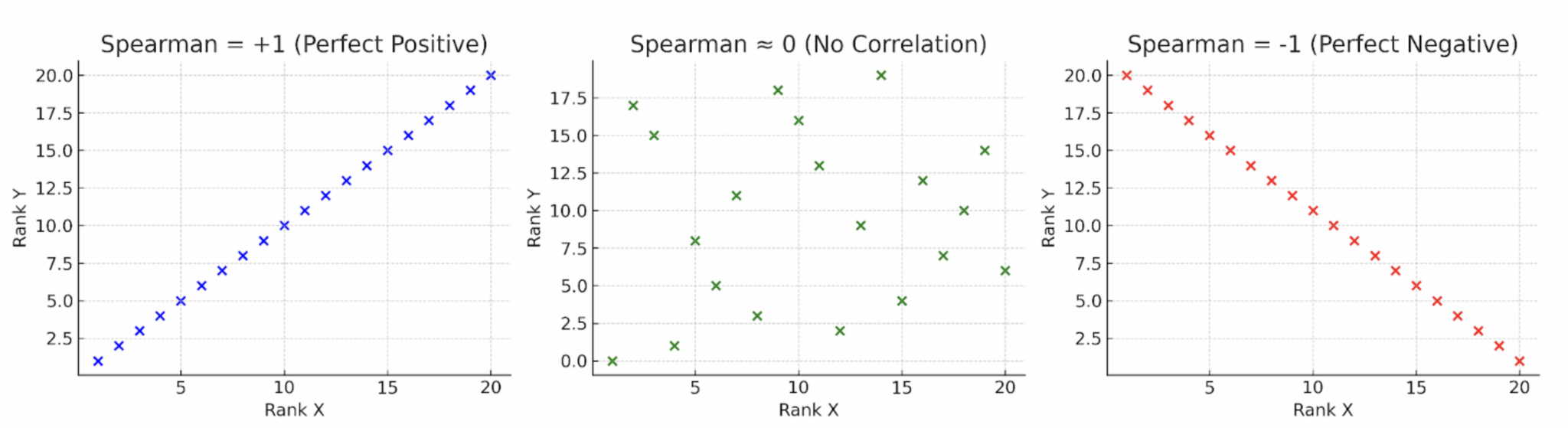

Spearman correlation

To measure the degree of correlation between metrics, I used the Spearman correlation coefficient.

Unlike Pearson correlation, which assumes linear relationships, Spearman looks at whether the ranking of one metric moves in step with another.

In simple terms, if domains with higher keyword counts also tend to rank higher for AI visibility, the Spearman value will be high even if the relationship is not a perfectly straight line.

A value near +1 means the two rise together consistently, near -1 means one rises as the other falls, and near 0 means no clear pattern.

Concentration of the HHI

I then measured citation concentration using the Herfindahl-Hirschman Index, a metric borrowed from economics.

It is calculated by summing the squares of market shares, in this case, each domain’s share of AI mentions in a sector.

An HHI closer to 1 means a sector is dominated by just a few domains, while values closer to 0 indicate citations are spread more evenly.

For example, an HHI of 0.05 suggests a concentrated landscape, whereas 0.02 points to greater diversity.

By combining AI visibility, citation counts, SEO scale (keywords and backlinks from Semrush), Spearman correlations, and HHI concentration, I built a cross-sector picture of who holds authority in AI-driven search.

Recent Comments