Facebook ad costs jump 21% in 2025, but still beat Google

Social ads remain small businesses’ go-to play despite rising costs. New benchmark data from WordStream LocaliQ shows Facebook’s average cost per lead (CPL) climbed 21% year over year to $27.66. By comparison, Google’s average CPL is $70.11.

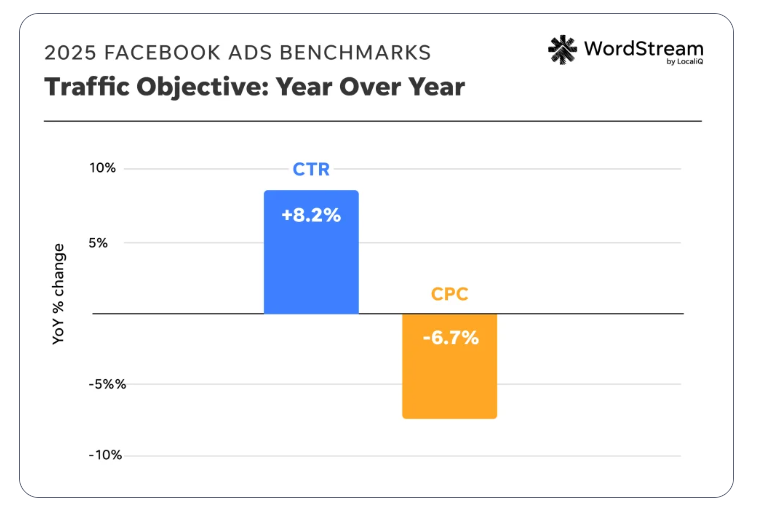

By the numbers. Traffic campaigns:

- CTR: 1.71% average, up from 1.57% in 2024.

- Highest: Shopping, Collectibles & Gifts (4.13%)

- Lowest: Automotive repair (0.80%)

- CPC: $0.70 average, down 6.7% YoY.

- Lowest: Shopping, Collectibles & Gifts ($0.34)

- Highest: Finance & Insurance ($1.22)

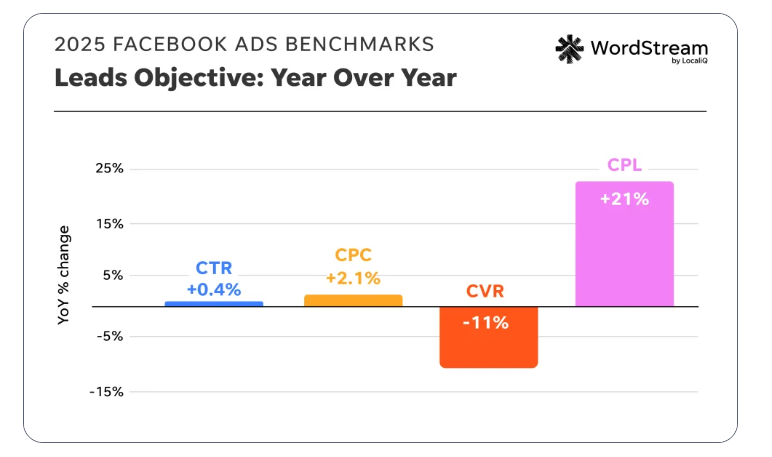

By the numbers – Lead campaigns:

- CTR: 2.59% average, flat YoY.

- Highest: Arts & Entertainment (3.92%)

- Lowest: Dentists (1.05%)

- CPC: $1.92 average, slightly up from $1.88.

- Highest: Dentists ($9.78)

- Lowest: Restaurants & Food ($0.74)

- Conversion rate: 7.72% average, down from 8.67% last year.

- Highest: Restaurants & Food (18.25%)

- Lowest: Furniture (3.77%)

- CPL: $27.66 average, up 21% YoY.

- Highest: Dentists ($76.71)

- Lowest: Restaurants & Food ($3.16)

Why we care. Advertisers should care because this data shows where Facebook is still delivering outsized value and where it’s slipping. Traffic campaigns are proving more efficient than ever, with cheaper clicks and stronger engagement. That makes them a smart play for driving awareness and site visits at scale.

On the flip side, lead-generation campaigns are becoming more expensive and less reliable, with conversion rates falling across most industries. For marketers, this means it’s no longer enough to simply run Lead Ads and expect strong ROI — success now depends on tighter targeting, smarter creative, and a sharper focus on lead quality.

The big picture. Traffic campaigns are improving (higher CTR, lower CPC), lead campaigns are weakening (higher CPL, lower CVR) and inflation/competition/privacy rules are squeezing advertisers.

The divergence reflects broader economic and competitive pressures. Inflation and tighter household budgets are likely depressing demand in categories like home improvement and personal care, where conversion rates fell sharply. At the same time, advertising costs are climbing across the board as more businesses fight for the same attention in a crowded digital landscape.

What they’re saying. “Although CPC, CVR, and CPL have all taken a hit this year, CTR improving in spite of higher costs means consumers are still engaging with ads — a good sign for businesses.” — Tyler Mask, Director of Optimization Strategy at LocaliQ

What’s next. Marketers will need to sharpen their strategies in 2025. Experts caution against chasing cheap clicks alone and suggest putting more weight on lead quality over quantity.

Meta’s AI-powered Advantage+ tools can help streamline campaigns, but should be used carefully to avoid wasted spend or poor-quality leads.

A balanced mix of campaign objectives — traffic, branding, and leads — is increasingly important.

Above all, advertisers are urged to keep their larger business goals in mind instead of optimizing for a single metric, since performance trends are shifting across industries.

Full report. Facebook Ads Benchmarks 2025: NEW Data, Trends, & Insights for Your Industry

Recent Comments