Why every AI search study tells a different story

Major SEO platforms, such as Ahrefs and Semrush, along with agencies like Seer Interactive and other leading companies, have released substantial studies that appear to offer definitive answers.

But a closer look reveals something else entirely: nearly every possible narrative about AI search impact has a “study” to support it.

The more I examined the data, the clearer a more uncomfortable truth became – no one has the definitive answer, and the numbers can be sliced to validate almost any storyline.

The core consensus that isn’t really consensus

At first glance, the major studies agree on fundamentals.

Ahrefs reports that top-ranking organic results lose approximately 34-34.5% of clicks when AI Overviews appear. Their analysis of 300,000 keywords presents this as a clear, quantifiable impact.

They reference research showing an almost 100% zero-click rate in Google’s AI Mode, suggesting that AI search poses a fundamental threat to website traffic.

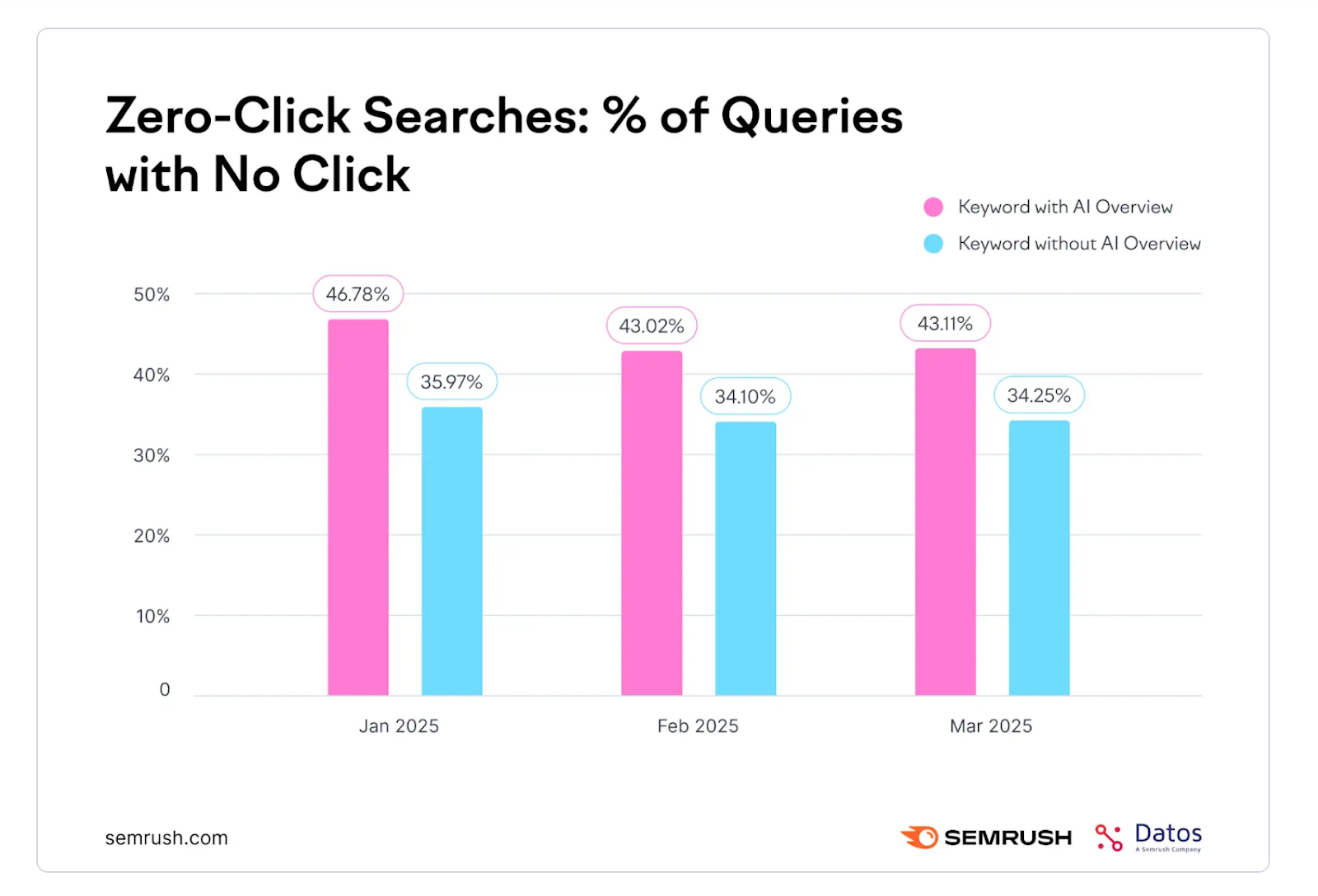

Yet Semrush, analyzing over 10 million keywords, found something different: a slight decrease in zero-click searches after AI Overviews were introduced.

This directly contradicts the narrative of AI features inevitably increasing zero-click behavior.

Instead of crisis, Semrush emphasizes opportunity, claiming that AI search visitors are 4.4 times more valuable than traditional organic visitors.

Neither can be entirely right, yet both are presented with statistical authority.

The conversion rate debate: 5 studies, 5 different answers

The confusion becomes even more pronounced when examining how AI search traffic converts compared to traditional Google organic traffic.

Here, the research becomes almost funny in its contradictions.

- Amsive’s research, analyzing hundreds of client websites, concluded that ChatGPT converts at a higher rate than Google. This “difference” finding suggests AI search educates users with top-of-the-funnel content before converting, and has higher commercial value.

- A study by Kaise and Schulze examining more than 973 ecommerce websites – covered by Search Engine Land – reached the opposite conclusion. ChatGPT converts worse than Google. For ecommerce businesses in particular, this research suggests AI search traffic is lower quality and less likely to generate revenue.

- Ahrefs examined its own conversion data and determined that ChatGPT converts better than Google. This aligns with their broader narrative that while AI search may reduce traffic volume, it increases traffic quality.

- Seer Interactive analyzed data from several client websites and also concluded that ChatGPT converts better than Google, supporting the “quality over quantity” interpretation.

- Peep Laja, founder of Wynter, reviewed his company’s conversion data and drew yet another conclusion: LLMs are sending “lazy, unqualified traffic” that converts poorly. His real-world business experience contradicts the optimistic interpretations from Ahrefs and Seer.

So which is correct?

Does AI search traffic convert the same as Google, better than Google, or worse than Google?

The answer appears to be: all of the above, depending on which data you examine.

Why every narrative has supporting evidence

The existence of credible studies supporting contradictory conclusions reflects the complexity and variability of AI search impact.

Several factors explain why research findings diverge so dramatically.

Industry and business model matter enormously

Seer Interactive’s finding that AI Overviews disproportionately impact non-branded traffic hints at this.

An ecommerce site selling commodity products likely experiences AI search very differently from a B2B software company or a local service provider.

Kaise and Schulze’s study, which focused on ecommerce websites, may capture a genuinely different reality than Ahrefs’ analysis of its own SaaS business or Seer’s client portfolio.

Query intent creates massive variation

A user asking ChatGPT, “What are the best running shoes for flat feet?” is in a very different mindset than someone typing that same query into Google.

The former may be later in their research journey, explaining why some studies find AI traffic converts worse.

Or they may be more deliberate, explaining why others find it converts better. Both could be true for different query types.

Time period and AI changes skew results

These studies were conducted across different months in 2025 as AI search features were rapidly evolving.

Early adopters of AI search tools may represent a different demographic than mainstream users.

A study from April captures a different user base and feature set than one from November.

Sample size and selection bias distort conclusions

Amsive’s 100 client websites, compared with the 900+ ecommerce sites examined in the Kaise and Schulze study, represent different data scales and industry mixes.

Ahrefs, analyzing their own conversion data, introduces potential selection effects.

Their audience skews toward SEO professionals who may behave differently from general consumers.

Laja’s single-company experience with Wynter may reflect something unique about his business rather than a universal pattern.

Measurement definitions aren’t standardised

What constitutes a “conversion” varies across studies.

- Are we measuring email signups, purchases, qualified leads, or something else?

- How is traffic attributed when a user touches multiple channels?

These definitional differences alone could explain contradictory findings.

Get the newsletter search marketers rely on.

See terms.

The Great Decoupling vs. The Great Opportunity

Ahrefs frames their findings as “The Great Decoupling.”

Impressions increase through dual visibility in organic results and AI Overview citations, but total clicks decrease.

This narrative emphasizes loss and disruption, positioning AI search as a zero-sum game where Google captures value previously distributed to websites.

(It seems the great decoupling was caused by AI tools sending a huge amount of impressions that Search Console counted as Brodie Clark found.)

Semrush presents essentially the same phenomenon through an opportunity perspective. Yes, click volume changes, but the visitors who do click through are more valuable.

Their projection that AI search could surpass traditional organic by 2028 positions this as an inevitable evolution that forward-thinking marketers should embrace rather than resist.

Both organizations are looking at similar data patterns but constructing entirely different narratives.

- Ahrefs emphasizes the 34% click reduction.

- Semrush emphasizes the 4.4 times value increase.

Neither is lying, but they’re telling very different stories.

The citation thing: Revolutionary or incremental?

All three major research studies identify a shift from ranking to citation, being mentioned in AI-generated answers matters as much or more than traditional position.

But here too, interpretations diverge.

- Ahrefs’ data showing that 76% of AI Overview citations come from Google’s top 10 organic results suggests this is largely an incremental evolution. If you’re already ranking well through traditional SEO, you’re likely to be cited more frequently. The existing system remains mostly intact.

- Yet Semrush notes that AI search tools frequently cite lower-ranking pages, suggesting a more revolutionary break from traditional ranking hierarchy.

- Seer Interactive’s finding that branded versus non-branded searches experience different impacts adds another layer. The citation economy may work fundamentally differently depending on query type.

So is the citation phenomenon a minor adjustment to existing SEO practices or a wholesale transformation?

Once again, there’s a study to support whichever narrative you prefer.

The hidden variable: What each researcher wants to be true

It’s worth noting that each organization conducting this research has business interests that may influence the framing, if not the methodology.

Ahrefs sells SEO tools primarily focused on traditional search optimization.

A narrative emphasizing disruption and complexity reinforces the need for sophisticated tools and expertise.

Their research, highlighting click losses and the challenge of adapting to AI search, serves their business model.

Semrush offers a comprehensive digital marketing platform, featuring AI-powered tools.

A narrative emphasizing opportunity and evolution rather than crisis positions them as forward-thinking guides to the future. Their optimistic framing of AI visitor quality serves their strategic positioning.

Seer Interactive, as an agency, benefits from complexity that requires expert guidance.

Their nuanced findings about branded versus non-branded impact – and variation across client types – reinforce the value of customized strategic consulting over one-size-fits-all approaches.

This doesn’t mean any organization is manipulating data, but it does mean that how data is framed, which findings are emphasized, and which storylines are constructed all reflect underlying business incentives.

Researchers naturally gravitate toward interpretations that align with their worldview and business model.

The segment-specific reality

The most honest conclusion from examining all this contradictory research is that the impact of AI search is radically segment-specific.

The right answer to “how does AI search affect traffic and conversions” is “it depends.”

It depends on:

- Your industry.

- Your business model.

- Whether your traffic is branded or non-branded.

- Where your customers are in their buying journey.

- Your content type.

- Your specific audience demographics and behavior patterns.

An ecommerce site selling commodity products through informational content may genuinely experience the nightmare scenario Ahrefs describes: a 34% click reduction with no compensating quality increase.

A B2B software company with strong brand recognition might experience the opportunity Semrush describes: fewer but higher-quality visitors.

A local service business might barely notice AI search impact at all if its customers primarily use branded searches.

Laja’s experience with Wynter, that LLMs send lazy, unqualified traffic, may be completely accurate for his business, converting B2B prospects through detailed case studies.

That doesn’t invalidate Ahrefs’ finding that their own AI traffic converts well, because they’re in different segments serving different audiences with different content.

The methodological illusion of certainty

Large sample sizes create an illusion of certainty that may be unwarranted.

The Kaise and Schulze study, which examined more than 900 ecommerce websites, sounds comprehensive and definitive.

But 900 ecommerce websites, while numerous, still represent a specific segment with shared characteristics.

The findings may be perfectly accurate for ecommerce while being completely wrong for B2B services, publishing, or local businesses.

Similarly, Ahrefs’ analysis of 300,000 keywords and Semrush’s examination of 10 million keywords provide impressive scale, but do not eliminate the possibility of systematic biases in:

- How keywords were studied.

- How effects were measured.

- What confounding variables went uncontrolled.

The confidence with which these studies are presented, with specific percentages and definitive conclusions, may exceed what the data actually support.

A more honest framing would acknowledge the uncertainty and variability, but that doesn’t make for compelling marketing or industry thought leadership.

What this means for SEOs and marketers

For SEO professionals, marketers, and website owners trying to understand what is happening, the contradictory research presents a challenge.

You can’t simply trust “the data” because the data tells different stories depending on who’s analyzing it and what they’re measuring.

The practical implication is that you must conduct your own analysis for your specific situation rather than relying on industry studies to tell you what’s happening.

Track your traffic sources meticulously. Measure conversion rates by channel. Monitor both volume and quality metrics.

Look specifically at how AI search traffic behaves for your business, rather than relying on an aggregated industry average.

The studies provide hypotheses to test, not conclusions to accept.

The answer will be specific to your segment, and the only way to know is through rigorous measurement of your own data.

The narrative selection problem

As more AI search studies emerge, a noticeable pattern has become apparent: the same phenomenon can be interpreted in vastly different ways.

Depending on how the data is sliced – the segment studied, the time period analyzed, or the metrics emphasized – research can support a wide range of conclusions about traffic, quality, and overall impact.

Each interpretation can appear data-driven and rigorous, yet the strategic takeaways often conflict.

This creates an environment where confirmation bias can easily surface.

Teams may naturally favor studies that align with their existing assumptions or strategic goals, while giving less weight to research that points in a different direction.

The result is an industry conversation where many believe they are “following the data,” but the available data supports multiple narratives – and the one selected often reflects priorities and context rather than a single objective truth.

The truth about uncertainty

The SEO and digital marketing industries are built on the promise of data-driven decision-making.

We measure, test, optimize, and prove ROI.

The existence of massive, well-conducted studies reaching contradictory conclusions threatens this entire framework.

It reveals that even with large datasets and sophisticated analysis, understanding complex, multivariate phenomena like AI search impact may be beyond our current capabilities.

The systems are too complex, the variables too numerous, the segments too distinct, and the landscape too rapidly evolving for any single study to capture definitive truth.

This doesn’t mean research is useless, far from it.

The studies from Ahrefs, Semrush, Seer Interactive, and others provide valuable data points and frameworks for thinking about AI search impact.

But they cannot provide the certainty and universal answers that marketers need and look for.

Moving forward without consensus

The path forward calls for a healthy level of methodological skepticism.

When a study concludes that AI search reduces clicks, improves conversion, or shows little measurable impact, the most useful response is simply:

- “Interesting research. I wonder what factors shaped this result and whether it applies to my situation.”

Instead of seeking the one true study that reveals the definitive impact of AI search, practitioners should:

- Acknowledge segment specificity: Your experience will vary based on industry, business model, content type, audience, and numerous other variables. Generic conclusions have limited value.

- Conduct rigorous self-measurement: Track AI search traffic sources, measure conversion by channel, monitor both volume and quality metrics, and let your specific data guide your strategy.

- Test multiple hypotheses: Rather than assuming Ahrefs or Semrush is right, test both possibilities. Optimize for AI citations while monitoring if traffic quality improves enough to offset volume declines. The answer may be different for different content types within your own site.

- Question narratives: When research perfectly aligns with the business interests of the organization conducting it, apply healthy skepticism. This doesn’t mean the data is wrong, but framing and emphasis matter enormously.

Be comfortable with ambiguity

The truth is uncomfortable: even with multiple large-scale studies from credible, industry-leading companies, we still don’t have clear answers about AI search’s impact.

We have data points, hypotheses, segment-specific findings, and business-driven narratives – not definitive conclusions.

The study that “settles it” doesn’t exist because the problem is too complex and too variable.

Researchers can find evidence for almost any claim, depending on what they measure and how they frame it.

That doesn’t mean research is useless or that all findings carry the same weight.

It means context matters, variation across segments is normal, and intellectual humility beats false certainty built on selectively chosen studies.

No matter the storyline – crisis or opportunity, disruption or evolution – you can always find a study to back it.

The wiser path is to hold conclusions lightly, run your own tests, and stay adaptable as the industry keeps shifting.

Recent Comments